Natural gas prices are more volatile during the winter heating season. I’ve adapted the code from Data Analysis for the Life Sciences to use natural gas daily price change and simulate a p-value.

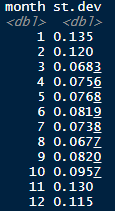

Actual monthly natural gas volatility since 2010:

ng1 %>% group_by(month) %>% summarize(st.dev = sd(ng.diff)) #find the st. dev. of each month’s prices

Separate daily natural gas prices into winter and not winter:

ng.not.winter <- ng1 %>% dplyr::filter(!month %in% c(“1”, “2”)) #control group

ng.winter <- ng1 %>% dplyr::filter(month %in% c(“1”, “2”)) #treatment group

Find the real difference in price volatility (standard deviation of price):

month.diff <- sd(ng.winter$ng1) – sd(ng.not.winter$ng1)

Create a null distribution by sampling:

set.seed(1)

n <- 10000

samp.size <- 12

null <- vector(“numeric”, n) #create a vector for the null distribution, holding the differences between means of samples from the same population

for(i in 1:n) {

ng.not.winter.sample <- sample(ng.not.winter$ng1, samp.size) #sampling from population of control

ng.winter.sample <- sample(ng.not.winter$ng1, samp.size) #sampling from population of control

null[i] <- sd(ng.winter.sample) – sd(ng.not.winter.sample)

}

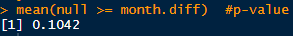

mean(null >= month.diff) #p-value

Not below 5%, but not bad. The p-value would decrease if we increased the sample size.

10% of samples from the control group (non-winter) have differences greater than the true difference. This is the p-value.

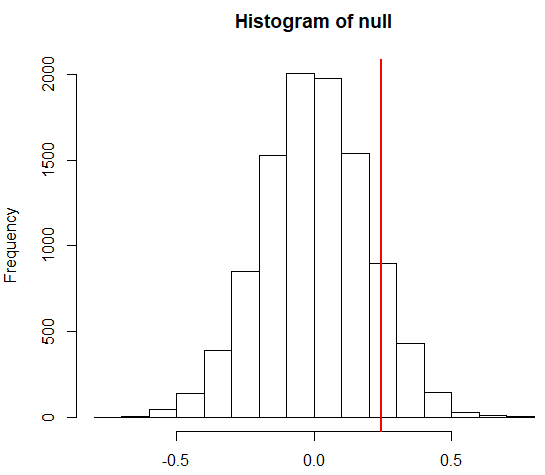

hist(null, freq=TRUE)

abline(v=month.diff, col=”red”, lwd=2)

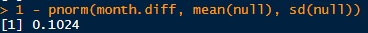

The histogram looks normal, so using a normal approximation should give a similar answer:

1 – pnorm(month.diff, mean(null), sd(null))