In honor of Robert Wenzel.

Gary North says that “Empires take time to develop, and at some point, they drain the financial resources of the nation that launched the empire. There are no exceptions to this process. Empire always produces bankruptcy.”

This is because empires are not undertaken in response to a need. They serve as a wealth transfer from the taxpaying masses to the special interests that are needed to expand and run an empire. The winners are the financiers of the empire, weapons makers, bureaucrats that run the empire, military people who enforce the rule of the empire and get neat looking ribbons and medals, think tanks, and so on.

The masses pay for the empire and the salaries of those who run it, and pay for the weapons and soldiers to control it, and supply the soldiers to die for it.

But there is no market being satisfied. The wealth transfer and capital misallocation and destruction needed to acquire it and maintain it eventually destroy the empire from within because it makes the majority poorer and corrupts the government.

This article by Gary North talks about the drag the administrative State puts on the lives and dealings of modern people. Administrative law, like the permanent security

State, is above and apart from the elected governments in many ways.

North also talks about the inevitable Great Default, where governments will be forced to capitulate on their promises to pay health and other entitlement programs in the future.

Technological innovation has brought massive gains in efficiency and productivity in the last several decades. These gains will likely increase at an increasing rate. The prospects for the future are laid out in a very long and influential article by Ray Kurzweil, who begins his essay like this:

“You will get $40 trillion just by reading this essay and understanding what it says. For complete details, see below. (It’s true that authors will do just about anything to keep your attention, but I’m serious about this statement. Until I return to a further explanation, however, do read the first sentence of this paragraph carefully.)”

If one does read much further, the $40 trillion comment is explained. Kurzweil says that exponential growth in technology, and hence efficiency, productivity, and wealth, imply that stock markets should triple, or rise $40 trillion in value.

Perhaps. But some other things could happen. Rapidly increasing technology is leading to greater connectivity between people, all of whom are buyers of some things and sellers of other things. It is becoming less necessary for large corporations to aggregate labor for the production of goods and services on one hand, and to distribute those goods and services, on the other hand. Technology will continue to allow more and more transactions to take place directly. Will many of the profits of these transactions accrue to sources not listed on stock exchanges? Will we see a re-localization of economies which will show the age of centralization and conglomeration to have been only a transitional state made necessary by a lack of technology?

How many corporations and their stock prices are boosted by the expectation of continued redirection of capital through governments? A Great Default would not only mean that health care spending (in total dollars) would go down, and with them the stock prices of the health care sector. The many corporations related to the war and surveillance State would be affected. Auto makers, energy companies, airplane makers, and many others receive huge government subsidies.

These two factors, greater connectivity which will remove the need for many corporate middlemen, and a general government default which will leave more money in people’s hands at the expense of connected corporations, lead me to imagine another world. This other world will see lower and less important stock markets, but greater total wealth in society as a whole.

Every non-coerced transaction leaves all parties better off. The future will see exponentially more transactions taking place in more efficient markets. Total wealth will rise exponentially. But stock prices might not.

And what of the administrative State? Will it be able to insinuate itself further into the dealings of our personally connected buyers and sellers? Exponential increases in connectivity would lead to exponentially more holes to possibly be filled by State administration. I don’t believe it would have the intelligence or the funding to be able to keep up. It could revert, due both to lack of funding and capability and to being out-competed by the private sector, to a night watchman role. Technology might lead to a re-distribution of wealth back to its producers.

What are the language implications of the New Silk Road? Will Mandarin be its lingua franca?

http://www.reuters.com/article/us-usa-oil-splitters-analysis-idUSKBN0UB08Z20151228

New splitter projects look less attractive as WTI-Brent tightens. This tightening has more to do with the reduced light oil production in the U.S. and less to do with removing the oil export ban. A future oil price rise will incentivize more U.S. shale production, widening the WTI-Brent spread out again, which would make splitters more attractive.

Brooks Adams, the great-grandson of John Adams and grandson of John Quincy Adams, saw danger in the consolidation of power in a centralized State, as opposed to the dispersion of power envisioned (by many, but not all, of the founders) at the nation’s founding. He wtote about it in The Law of Civilization and Decay. Again from The Conservative Mind:

“Just how far the acceleration of the human movement may go it is impossible to determine; but it seems certain that, sooner or later, consolidation, having reached its limit, will necessarily stop. There is nothing stationary in the universe. Not to advance is to go backward, and when a highly centralized society disintegrates under the pressure of economic competition, it is because the energy of the race has been exhausted.”

I might amend Adams’ use of the word “economic” and instead use “political”, for economic power becomes subsumed to political power as that power is centralized. Economic power is then redistributed from the central power, the State in D.C., back to its original geographic sources in the provinces, but this time to the State’s preferred hands, those who play the game and know how to feed power and what to ask in return.

This centralized State, being short-sighted and greedy, unable to plan, able only to maximize today’s gains at tomorrow’s expense, is doomed to break apart. It may voluntarily relinquish some of its powers, but that is a sign that it is desperate, and that the relinquishing of power has only begun and will soon take on a life of its own.

“El Salvador is a recent example of corporate domination in U.S. foreign aid. The United States will withhold the Millennium Challenge Compact aid deal, approximately $277 million in aid, unless El Salvador purchases genetically-modified seeds from biotech giant, Monsanto. The Millennium Challenge Corporation is “a U.S. foreign aid agency that was created by the U.S. Congress in January 2004,” according to Sustainable Pulse, and serves as a conduit for foreign aid funds. MCC’s unethical aid conditions would force El Salvador to purchase controversial seeds from the American biotech corporation instead of purchasing non-GMO seeds from the country’s local farmers – an action that would have negative effects on El Salvador’s agricultural industry in addition to presenting serious health and environmental risks.”

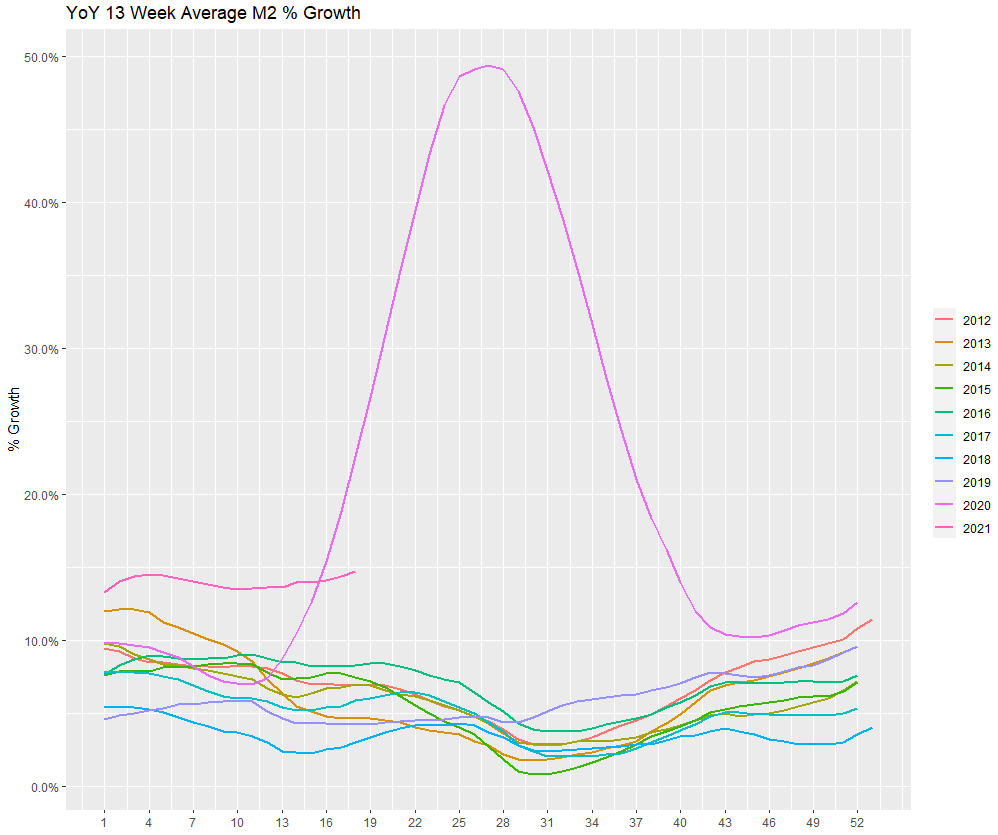

Real 6 month interest rates are negative and M2 growth is above 6%:

while Brent crude prices are trading in a narrowing range:

Will the low/negative interest rates continue to support or will growing supply pressure crude down?

Craig Pirrong exposes the tactics of Warren Buffett and many others throughout history (link):

“First, it’s long been known that some firms in an industry can benefit from the imposition of more stringent safety regulations. Yes, these regulations raise everybody’s costs, but some firms’ costs rise more than others. The less-impacted firms have an incentive to press for the regulations in order to raise their rivals’ costs. This raises market price. The effect on price more than offsets the effect on cost for the less cost-impacted firms.

Which means: always look askance at people like Buffett who are calling for regulation of their industry.”